While I often loathe meetings, I do realize and appreciate the importance. There are things that will not always be effectively accomplished over the phone, on a conference call, in a WebeEx, or with certain individuals not able to be present or involved.

The Value in having a “Meeting”

I think the real value of “the collective congregation of people in the effort of accomplishing business”, or simply defined as “a meeting”, is to make sure that those people don’t miss the opportunity to hear or speak on something critical.

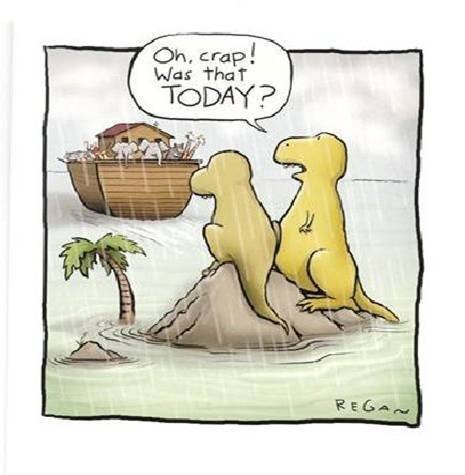

The cartoon does illustrate the irony of the dinosaurs missing the boat. They missed out on continuing the existence of their species! But it also reveals what the boat missed out on… the existence of their species!

Deliver Value, Bring Value, Share Value

So while you have meetings to disseminate information, do not disregard the more important value of allowing others to be involved to engage and share their own ideas of what will and won’t work!

Without the exchange of ideas we all have the potential for good ideas and works to become extinct!

I still get annoyed by some meetings ![]()

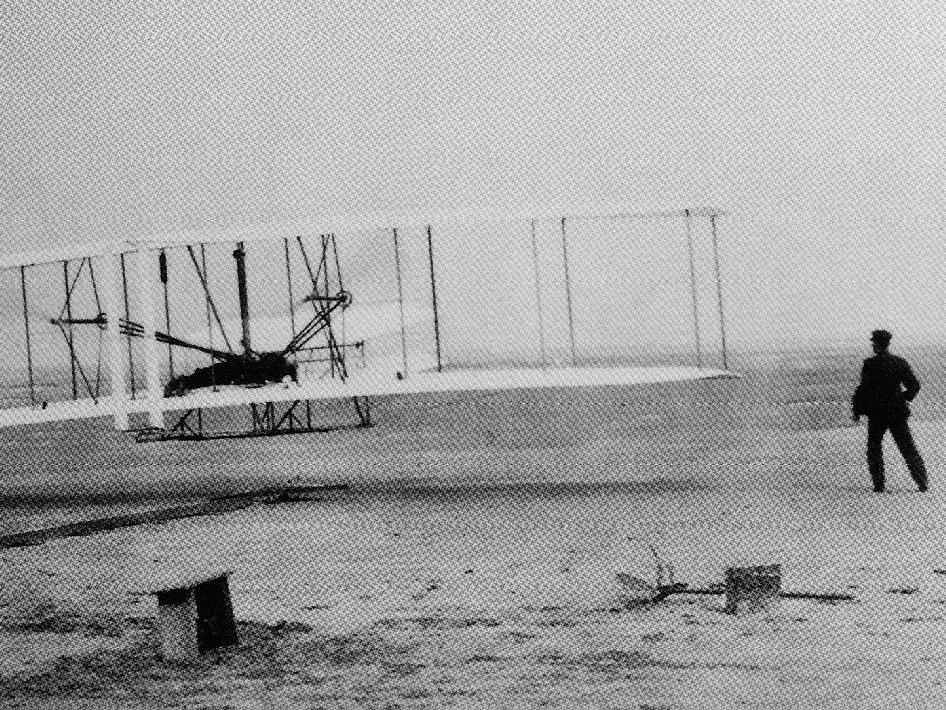

This brings me to the wheel. The wheel is probably the most important mechanical invention of all time. Nearly every machine built since the beginning of the Industrial Revolution involves this single, basic principle embodied in one of mankind’s truly significant inventions. It is hard to imagine any mechanized system that would be possible without the wheel or the idea of a symmetrical component moving in a circular motion on an axis. Various references all over the internet state that from ancient drawings, the earliest known use of this invention was a potter’s wheel that was used in Mesopotamia (part of modern day Iraq) as early as 3500 BC. You can find a wheel like component in every part of your life. It has been reworked, downsized, enlarged, given spokes and saw like grips. Yet everyone says “

This brings me to the wheel. The wheel is probably the most important mechanical invention of all time. Nearly every machine built since the beginning of the Industrial Revolution involves this single, basic principle embodied in one of mankind’s truly significant inventions. It is hard to imagine any mechanized system that would be possible without the wheel or the idea of a symmetrical component moving in a circular motion on an axis. Various references all over the internet state that from ancient drawings, the earliest known use of this invention was a potter’s wheel that was used in Mesopotamia (part of modern day Iraq) as early as 3500 BC. You can find a wheel like component in every part of your life. It has been reworked, downsized, enlarged, given spokes and saw like grips. Yet everyone says “