Sometimes a simple visual can help everyone gain perspective around what is fantasy and reality!

Sometimes a simple visual can help everyone gain perspective around what is fantasy and reality!

I was once again a guest on the famous DriveThruHR daily a few weeks back (Aug 8, 2011). We had scheduled my appearance about 2 weeks before and how funny was it that on the Monday they asked me the question “What keeps you up at night?” that Standard and Poor’s had just announced the downgrade of United States from AAA to AA. Ahhh… well here we are; William Tincup, Bryan Wempen and I discussing Work, Business and the affects of the S&P downgrade. I am no economist but I am aware!

Enjoy and let me know what you think!

(A short commercial may run before the interview begins)

NOTES:

The Debt Ceiling Story – An analogy (From the MarketingHeadHunter.com):

The U.S. Congress sets a federal budget every year in the trillions of dollars. Few people know how much money that is so we created a breakdown of federal spending in simple terms. Let’s put the 2011 federal budget into perspective:

It helps to think about these numbers in terms that we can relate to. Let’s remove eight zeros from these numbers and pretend this is the household budget for the fictitious Jones family.

The S&P Downgrade – Background: AAA to AA+

So there will be two things we will need to focus on

Business (Leadership Challenges): China complained but is still buying US Treasuries. Why? Out of safe bets we are still the safest.

S&P Work (Motivation – Physiological and Safety):

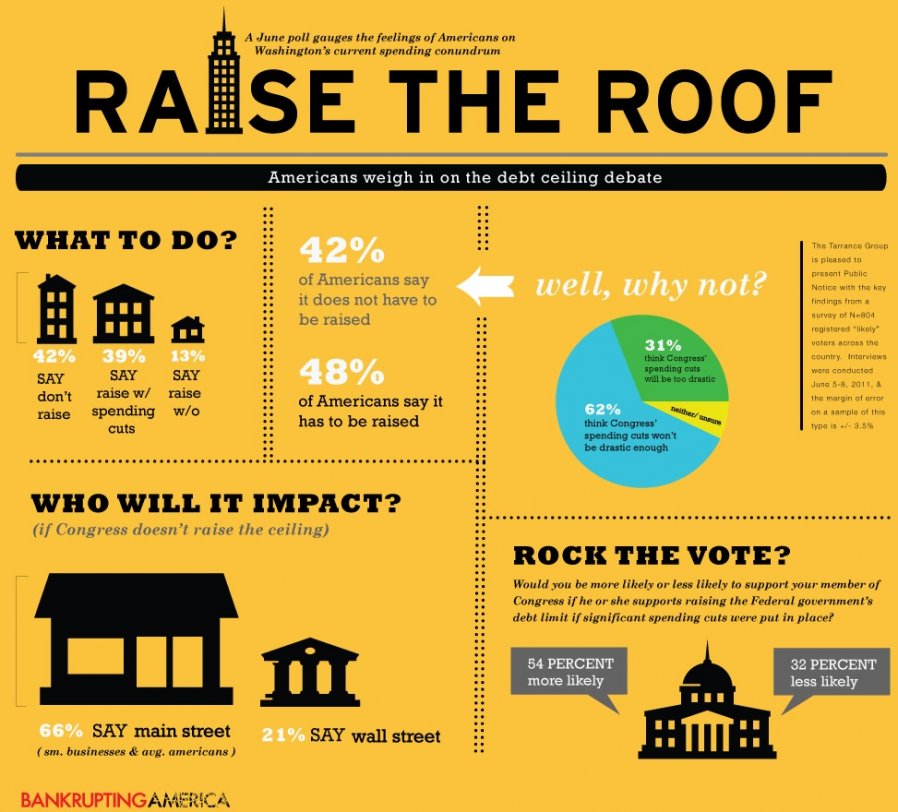

As you can see from the graph above Americans had their beliefs around raising the debt ceiling. With the recent downgrade of US to AA by Standard and Poors the following article seems rather fitting. Janet Harrah is senior director of Northern Kentucky University’s Center for Economic Analysis and Development. This article appeared on July 31st, 2011 edition of the Cincinnati Enquirer. My opinion has paralleled Ms. Harrah’s for awhile, however, we often forget that a fix to our most difficult issues rely more on us changing our habits than that of our government! Enjoy…

The American debt crisis is played out on a smaller scale every day in workplaces across America. You head off to work in the morning. At the end of the day, if you want to keep that job, you please your boss. For politicians, the boss is the American Voter.

So what is wrong with those politicians in Washington? Why can’t they reach a compromise? Actually, those are the wrong questions. The real question is: what is wrong with American voters?

Most Americans seem to understand we can’t spend more than we make over the long haul when it comes to our own personal finances. Yet, when we enter the voting booth, we seem to believe it should somehow be different for the federal government.

When forced to face the current stark fiscal reality, our elected officials propose one of two distinct viewpoints as if they were mutually exclusive: Democrats insist the problem has to be solved by taxing the rich and no one else. On the other hand, the GOP insists the problem has to be solved by spending cuts.

Here is the problem with that stark contrast in viewpoints. Who are the “rich” we want to tax? Is it anyone who makes a dollar more than me? Is it the small-business owner creating jobs and profits? And which programs should we cut? Virtually every voter benefits from one or more federal program and the politicians who want to be re-elected have to find acceptable spending cuts in programs that are large enough to impact the deficit and are at the same time not too objectionable to their constituents.

In other words, regardless of political party, it is as if we each tell our representatives, “Solve the problem without raising my taxes or cutting the spending that benefits me.” Such perspectives have led to each party taking an unswerving hard line in the current debt crisis negotiations.

With the 2012 presidential election looming, yet still a year away, how do the parties compromise without somebody losing face? The likely outcome is a deal that pushes the hard choices off until 2013. At that point, it will be: Debt Ceiling Crises: Round Two.

The only real way to deal with the long-term issues involved is for every American voter to embrace the concept that they must be willing to participate in the sacrifice. Our neighbors cannot and should not bear the burden alone.

If Americans are truly interested in improving the fiscal health of the country, we will tell politicians, “I am willing to pay more taxes,” or “I am willing to have cuts to spending that benefit me.” For example: if you are currently living on Social Security, are you ready to accept a freeze in benefit levels for the next five years? If you are heading off to college, are you ready to foot the bill without Pell Grants or federally backed student loans? As a homeowner, are you ready to forgo the mortgage-interest tax deduction? If you are in the 15 percent tax bracket, are you willing to pay an additional 2 or 3 percent in federal income taxes?

We, the American voters, are the ones who hold the solution to this crisis, not the Beltway politicians.

It is up to us, as the government’s bosses to make certain that our country’s finances are put back in order. That will only happen when we consistently reward those officials who are willing to make the hard choices by re-electing them. Until then, stay tuned for more turmoil.